On 1 April 2017 there was a major Revaluation of commercial business rates.

Much of the media coverage was focused on the new Rateable Value (RV) levels and in many cases businesses saw significant increases. Rates bills are calculated by applying a Uniform Business Rate (UBR), also known as Poundage Rate, to the RV.

There are lots of terms and it can be confusing however, there is a simple and helpful online business rates calculator which ratepayers in Scotland can utilise to calculate bills:

https://www.mygov.scot/business-rates-calculator/#introduction

This calculator gives an estimate of your business rates bill for 2017-18 based on the information you enter. It also shows which Council is responsible for administering the rates on your property.

The calculator is currently using draft valuations for 2017-18. You should have now received Formal Valuation Notices from the Assessor before 1 April 2017.

If you are worried about the rise in rates then you might be able to lodge an appeal but please note that you have until September to do this to don't leave it until later - contact our team to see if you have a case in the first instance.

The calculator works as follows:

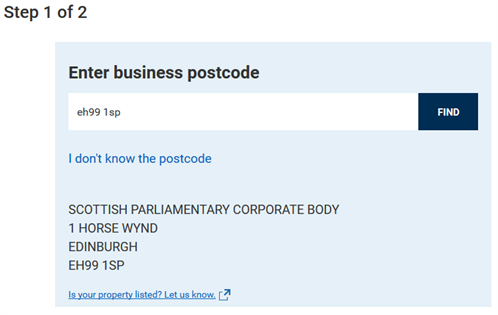

To use the calculator, information wise, you'll need either:

- the property postcode;

- or the street name/details

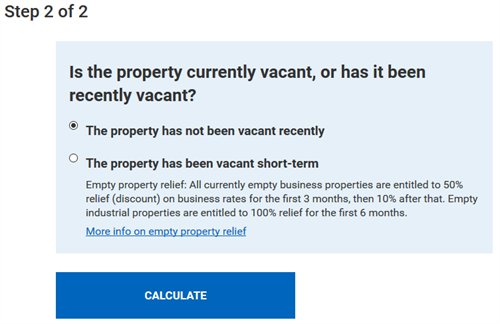

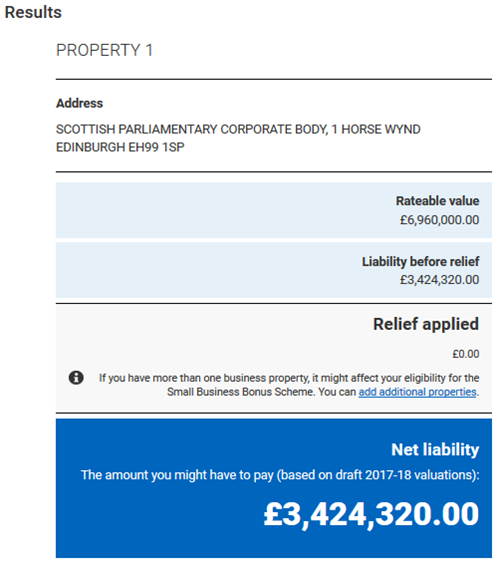

Any Reliefs (discounts), e.g. Small Business Bonus Scheme, and net liability may not be comprehensive if the property receives other discretionary reliefs.

Thereafter, it is a simple two-step process and calculator as follows:

*The following images are illustrative only and are not interactive; please refer to 'mygov.scot' weblink above for live calculator*

In terms of the calculation, the standard UBR is actually reducing from £0.484 to £0.466 in April. There is also current Large Business Supplement of £0.026 which will remain as it is, however, the good news for many ratepayers is that the threshold upon which this supplement applies will increase from RV over £35,000 to RV over £51,000.

As mentioned above, there are also a number of other potential Relief schemes available when calculating business rates, e.g. Small Business Bonus Scheme, Empty Property Relief etc, which can prove beneficial to eligible businesses. We will address this under a separate article in the near future.

Remember the closing date to lodge an appeal is September so contact us now to help in any way we can.